Difference between revisions of "Introduction"

(→Dedication) |

(→Dedication) |

||

| Line 2: | Line 2: | ||

==Dedication== | ==Dedication== | ||

| + | |||

::[[Image:Dedication.jpg|500px]] | ::[[Image:Dedication.jpg|500px]] | ||

Revision as of 13:24, 8 April 2022

To view a pdf version of this Introduction, click here: [1]

Contents

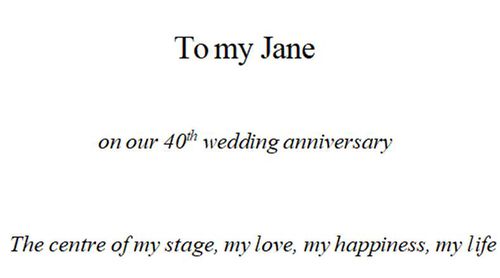

Dedication

Scope of this book

There are three themes to this book:

(1) Taxation of foreign domiciliaries

(2) Taxation of non-residents on UK assets

(3) Taxation of UK residents on foreign assets

To attempt to cover these topics comprehensively is ambitious, perhaps quixotic. This book is in danger of bursting, but one cannot address the first topic without the second and third, and these territorial issues can only be fully understood in a wider context: in taxation, as in life, everything is connected. Thus what started as a short book on foreign domiciliaries has become a work which seeks to address all territorial limits to UK taxation, and I discuss in the round other topics which often arise in this context, such as tax avoidance, and disclosure and compliance.

A statute-focussed approach

I set out statutory and other material verbatim:

- ... in the end we must always return to the words of the statute[1]

Returning to the verbatim text, it is surprising how often one finds that the words do not say what one expects.

This is not just a common law approach. Richard Hyland tells this story of his class at Université Paris II Panthéon-Assas:[2]

- Mme Gobert asked simply: L’article 2 du Code civil, qu’est-ce qu’il dit? Article 2 of the Civil Code, what does it say?

- My classmates were some of the best private law students in France. This was a question to which they knew the answer. One of the explained that article 2 provides for the nonretroactivity of the law. Mme Gobert looked at the student without smiling. Then she repeated the question. L’article 2 du Code civil, qu’est-ce qu’il dit? A different student mentioned Paul Roubier’s suggestion that a new law may be applied to les situations juridique en cours. Again she repeated the question. L’article 2 du Code civil, qu’est-ce qu’il dit? Another student tried, and then another, each new voice attempting yet a more refined statement of the concepts involved. After each comment she responded in the same way. It was my first French law class, so I did no know what to think. It seemed like a Zen-like version of the Socratic method. The French students were terrified. This was material they thought they knew, and yet they could not guess what was on her mind. Finally, one of the students had the presence of mind simply to read the code provision aloud. Mme Gobert’s eyes lit up. Mais bien sûr! she responded C’est ça qu’il dit!

The year 2021/22 in review

OTS stated in 2017:

- The UK tax code is widely cited as being the longest in the world”.[3]

This claim had been made at least since 2010.[4] In recent years Parliament added:[5]

| Finance Act(s) | Pages | |||

| 2012 | 703 (a record) | 2017 | 829 (2 Finance Acts)[6] | |

| 2013 | 648 | 2018 | 196 | |

| 2014 | 668 | 2019 | 337 | |

| 2015 | 597 (2 Finance Acts)[7] | 2020 | 217[8] | |

| 2016 | 662 | 2021 | 428 |

OTS estimated HMRC guidance at 90,000 pages in 2018;[9] whatever the true figure, it will have grown considerably since then. This guidance was “not comprehensive” - something of an understatement; but according to the OTS “real life cannot be reduced to a neat description in a few (?) pages of writing”.[10]

OTS has not achieved any perceptible improvement, at least in relation to the topics covered in this book.[11]

It is easier to talk of simplification:

- Our system remains too complicated ... We will therefore simplify the tax system. [12]

The reader may think that satirists better identify the reality:

- We will further complicate the UK tax system so that large companies can no longer find loopholes.[13]

The task of dealing with the effect of Brexit has begun: a decade will not suffice for this, and this area of law will remain in a state of flux for the foreseeable future.

Scotland continues its fiscal drift from the UK, with Northern Ireland and Wales following.

FA 2022 changes relevant to this work include:

- A new code for disclosure of uncertain tax treatment by large business; I discuss here its possible impact for other taxpayers

Important cases plodding their way through the appeal system include a clutch of ToA cases: Fisher, Rialas, Davies, Hoey.

The Court of Appeal have decided Embiricos v HMRC, a lamentable decision that will add vastly to the already substantial cost of tax litigation.

The TLRC have brought out a paper on judicial delay,[14] which I described in the last edition as “the most worrying development to those who care about the administration of justice”. One might, perhaps, hope to see improvements.

The future

The Economic Crime (Transparency and Enforcement) Act 2022 will set up a beneficial ownership register of overseas entities that own UK property.

2023 is to see a rise in CT from 19% to 25% (which has been widely discussed) and a return of the complexities of small profits relief (which has not).

We face an extended period of change and uncertainty, in politics, economics, public health, law and taxation, and will continue to live in fiscally exciting times.

Thanks ...and request for help

I am very grateful to my colleagues in chambers, especially Robert Venables QC, Philip Simpson QC and Rory Mullen QC, for discussions on many aspects of tax. Yanpei Zhang as research assistant resolved many puzzles. I owe a great debt to Jane Hunt and Ruth Shaw who work committedly on this text throughout the year.

Comments from readers and professional clients continue to be of the greatest value and interest to the author.

The pleasure in writing this book consists in the interest of the questions which it raises, and the success which it may have achieved in answering them. On the basis of what is known at 1 April 2022, it seeks to state the law for 2022/23.

| James Kessler QC | ||

| Old Square Tax Chambers | ||

| 15 Old Square Lincoln’s Inn WC2A 3UE |

[email protected] https://www.kessler.co.uk |

Obtaining Further Advice - And Disclaimer

Further advice

If you want advice on which you are legally entitled to rely you can obtain it - but not from this work.

In particular, you may instruct the author to advise. I enjoy writing, but spend most of my time giving independent specialist professional advice in private client matters, especially areas covered in this work. For further details see https://www.kessler.co.uk https://www.kessler.co.uk

TFD Online

TFD Online is an online version of this book and more. It can be used:

(1) to search the text of this book or to access it online.

(2) to see if the book has been updated

(3) to correct or contribute to the book

TFD Online is moderated by Rebecca Sheldon, a member of Tax Chambers, 15 Old Square, Lincoln’s Inn.

TFD Online is accessible on https://www.foreigndomiciliaries.co.uk An authorisation code for a 3 week trial period is in the inside cover of volume 1.

Disclaimer

The professional bodies issue the Professional Conduct in Relation to Taxation with a disclaimer:

- While every care has been taken in the preparation of this guidance[15] the PCRT Bodies do not undertake a duty of care or otherwise (?) for any loss or damage occasioned by reliance on this guidance. Practical guidance cannot and should no be taken to substitute appropriate legal advice.[16]

When that appeared in 2011 it seemed extraordinary. But nowadays no professional body issues guidance without a disclaimer.[17] Similarly, and a fortiori, the views expressed in this book are put forward for consideration only and are not to be relied upon. Neither the author nor the publisher accept responsibility for any loss to any person arising as a result of any action or omission in reliance on this work. But could anyone have thought that a claim might arise in absence of this disclaimer?

A note to the lay reader

This book is not intended as a self-help guide, and is addressed to tax practitioners. In earlier editions I said: “... but it is readable for a lay person.” I think that is still true, though the text is more daunting than when I first wrote those words, because the law has become much more complicated. However, initiation in these matters must often be by the taxpayer. If you wish to research this subject in depth, and so take more control of your own tax affairs, read on. But for implementation you will need to find professionals to advise you. Self-help guides extol “the benefit of bypassing expensive lawyers”; but the bypass may prove the more expensive route in the long run.

Edition history

1st 2001 8th 2009 15th 2016 2nd 2003 9th 2010 16th 2017 3rd 2004 10th 2011 17th 2018 4th2005 11th 2012 18th 2019 5th 2006 12th 2013 19th 2020 6th 2007 13th 2014 20th 2021 7th 2008 14th 2015

This book was called Taxation of Foreign Domiciliaries for 9 editions; it changed to Taxation of Non-Residents and Foreign Domiciliaries in the 10th edition.[18]

Footnotes

- ↑ R.F.C. 2012 Plc v AG [2017] UKSC 4 (the Rangers case) at [11]; see A judicial gloss

- ↑ Hyland. Gifts: A study in comparative law, 1st ed (1989) p.xvi.

- ↑ It is hard to empirically assess the claim that the UK has the longest tax code in the world, and OTS makes no attempt to do so. But if any readers are aware of other serious contenders for that title, I would be interested to hear.

- ↑ For older references see the Introduction to the 2016/17 edition of this work.

- ↑ Finance Act page counts are a rough proxy for the ever growing complexity of the UK tax system, but not an altogether bad one. A (slightly) better proxy would also consider secondary legislation and HMRC guidance; and, perhaps, case law; then the page counts would multiply the Finance Act numbers set out here tenfold. For a discussion of the multidimensional concept of tax complexity, see Tran-Nam and Evans, “Towards the Development of a Tax System Complexity Index” (2014) Fiscal Studies Vol 35 p.341. OTS have published two (somewhat simplistic) discussions of tax complexity: Length of Tax Legislation as a Measure of Complexity (Apr 2012) OTS Complexity Index (2012)

- ↑ This is the combined length of the two FAs 2017.

- ↑ This is the combined length of the two FAs 2015.

- ↑ The unusually short length of the FA 2020 is due to the December 2019 election.

- ↑ OTS, “Guidance for taxpayers: a vision for the future” (2018) para 1.21. These pages have assuredly not been printed or counted. Quantification raises methodological issues which deserve a short essay to itself. We have reached the stage where even the amount of HMRC guidance is impossible to quantify: the words are uncountable. Within the limits of guesswork, and assuming 500 words per page (single spacing), the figure of 90,000 pages seems to me to be on the low side. There are 150 HMRC Manuals, just for a start. Perhaps the focus of enquiry should be whether HMRC guidance is too short, because 90,000 pages would not be sufficient to do justice to the topic. The legislation, measured by pages of the Orange & Yellow tax handbooks, can be counted and amounts to 20,836 pages in 2020/21 (that does not include DTAs, which would be another 3,000 pages). The Tax Cases exceed 80 volumes and do not cover VAT.

- ↑ Para 1.24.

- ↑ See eg IFS, “OTS: Looking Back and Looking Forward” TLRC Discussion Paper No. 11 (2014) tactfully referring to “insufficient buy-in to the simplification process by HMRC, HM Treasury and government”. But this view is not held by OTS: see Sherwood, Evans and Tran-Nam “The Office of Tax Simplification - The Way Forward?” [2017] BTR 249. In (I think) 2013 the government came up with the slogan “Creating a simpler, fairer tax system” under which OTS now operates; which imagines away a troubling reality in which simplicity and fairness are competing values which require hard choices.

- ↑ Conservative party manifesto 2017 p.14 Perhaps the mask has been put aside. OOTLAR 2008 had 45 references to simplification, but OOTLAR 2021 has none.

- ↑ Official Monster Raving Loony Party Manifesto 2017

- ↑ The tax tribunals: the next ten years (2021)

- ↑ PCRT is not in fact guidance: it is mandatory

- ↑ Professional Conduct in Relation to Taxation (2019), Forward. The second sentence is an improvement on the common form that guidance on legal issues “does not constitute legal advice”; that seems an idiosyncratic use of the word “advice"”; that seems an idiosyncratic use of the word “advice.

- ↑ For instance, the Law Society likewise issue a disclaimer for their Practice Notes: The standard form is: “While care has been taken to ensure that they are accurate, up to date and useful, the Law Society will not accept any legal liability in relation to them.”

- ↑ The text of earlier editions is available on https://www.foreigndomiciliaries.co.uk